Did You Know That There Are 5 Financial Mistakes That Over 90% Of Dropshipping Businesses Make?

And Making Just ONE Of These Mistakes Could Kill Your Cash Flow & Sink Your Business For Good…

Discover The Financial Mistakes You Should Avoid

Why Choose Us?

How We Can Help

We partner with you to provide with tools and strategies to help you build a stronger financial foundation for your business.

Tax strategies that can save you thousands each year.

Strategy to guide you on how to better manage your cashflow.

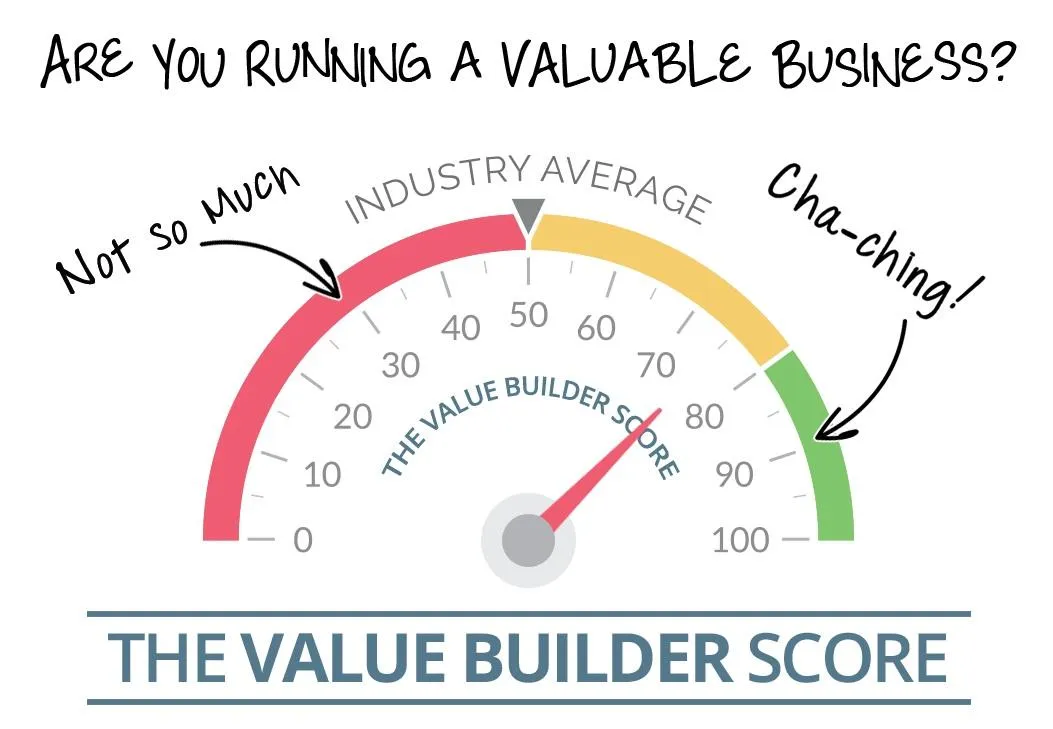

Provide you with the tools to increase the value of your business.

Provide you with the financial support you need grow.

An accountability partner to help you on journey to reach your goal.

You had a goal when you started your business. We work with you give you what you need to make informed decisions for the growth and success of your business.

SERVICES

Our Areas of Expertise

We offer services to help you implement processes to increase profits, cash flow and the valuation of your business. No matter what stage your business is in we have a solution for you.

Tax Planning

They say there are only two things certain in life... death and taxes. Learn how the strategies to legally minimize what you owe, and increase your bottom line.

Financial Coaching

This program is designed to help business owners gain a better understanding of their business and personal finances. To help you understand your numbers so you can make better business decisions.

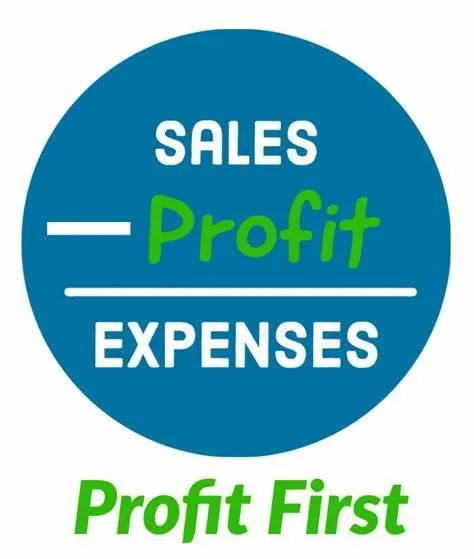

Profit First

We will help you implement the cash management system that will transform your business from a cash eating monster to money producing machine.

Value Builder

Your business is the most valuable asset that you will own. Don't leave money on the table when you exit. We will guide on the key drivers that impacts the value of your business.

We Are Calculating The Best Opportunities For You

Most Entrepreneurs focus on marketing and product/service delivery for their customers, but one of the most important elements of business is often ignored..... the numbers.

Numbers are the language of business, and as the saying goes what is not measured can't be managed.

You don't need to be an expert in accounting, but you need to understand the key drivers to have a growing and profitable business.

No matter if you are looking to grow a profitable business, or eyeing to exit your business in the next three years, we have solutions to guide you on your entrepreneurial journey.

Reduce Taxes

Save Money

Focus On Growth

Easily Understand Your Financial Health

Check Out Our Blogs

Articles On Various Financial Topics For Your Business

5 Common Budgeting Mistakes

As a small business owner, you strive to make the right decisions in every area of operations, from customer service to hiring practices. Yet, when it comes to managing your finances and budgeting, it... ...more

Finance

June 06, 2023•3 min read

How Accounting Helps Small Business Owners in Managing a Successful E-commerce Business

One of the biggest challenges of running an e-commerce business is managing finances. Many sellers struggle with budgeting and end up making costly mistakes that can hurt their revenue and bottom line... ...more

Finance

June 05, 2023•3 min read

Why Cashflow is More Important Than Profit in Business

Cashflow is the lifeblood of any business – without sufficient funds coming in and out of the company, operations grind to a halt. ...more

Finance

May 18, 2023•3 min read

Testimonials

Taxes

Thank you Adam Wayne for providing me with an informative and eye opening tax consultation. What I appreciate most is your patience with all of my questions. You made sure that I left the meeting with an understanding of concrete action steps that I need to take to improve my tax liability for 2022. Your professionalism and expertise were refreshing.

Dee

July 12, 2022

Bookkeeping and Taxes

"Adam is very informative, patient, and responsive. I know absolutely nothing about accounting and he explains it until I understand it. He is also very professional and kind. I recommend him to all of my colleagues.

Thank you Adam!"

Liz

January 4, 2021

Working with us is easy as 1-2-3

There are three steps to working with us

Discovery Call

During this call we will discuss your business and understand your needs.

Strategy Session

During this meeting we will review where your business is currently to better understand what is working and the opportunities that exist.

Create A Plan

We create a roadmap to incorporate your business goals. We will be your partner in helping your reach your destination.

At Neway Financial Management, we offer a 90-Day Moneyback Guarantee

If you are not 100% satisfied within the first 90 days, we'll refund to you 100% of the monthly investments you paid to our firm in those 90 days.

(That's how confident we are that you will love our services!)

The Overlooked Owner eBook

How do you determine the value of your business?

You might think this involves an in-depth look at your books, sizing up the market, and many other types of quantitative analysis.

But a study of 1,511 companies uncovered an often-omitted factor when assessing company value—the business owner.

© Copyright 2024. Wayne Financial Management.

All rights reserved.

Wayne Financial Management is not a CPA firm.

2022 All Rights Reserved.